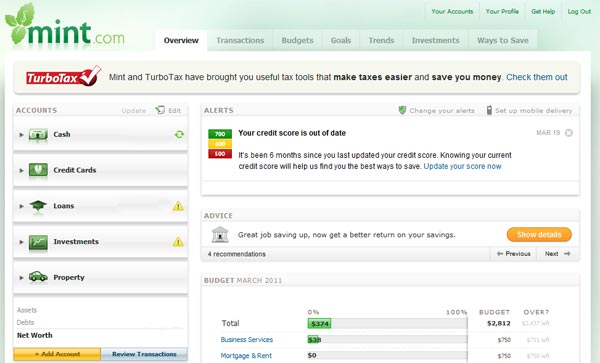

Other benefits include Mint’s weekly email summaries that explain a user’s finances over the previous week. For the ideal credit score, you should strive to keep your credit card usage under 30 percent. Under the “Bills” section in the “Overview” tab, it will show a usage ratio defined as the total amount by the user on his credit card divided by the credit limit. In addition, Mint has just added a credit utilization ratio feature. A wealth of information can be reviewed including age of credit accounts, credit score, errors, payment history, and more.

#Mint personal finance software free#

Recently, Mint launched a free credit score tracking option, allowing users to track their financial picture by logging in to their account and clicking on the “Show Details” button.

#Mint personal finance software install#

The Mint App doesn’t have any direct financial perks, but it does offer some benefits that other financial management apps do no, such as not requiring users to install any software.

This can be done through an email or a SMS message. Users can set goals like paying off debt or establishing an emergency fund, and then they can view their progress and data through graphs.įor those concerned about security, Mint has a two-factor authentication that validates your identity before logging in. The more information, such as from credit cards and expenses, that you put into Mint, the more you get out of it. Mint’s dashboard provides a summary of your personal finances with financial data that’s automatically updated. Users can develop a budget for each specific category as way to keep their finances on track. Once the data has been loaded, Mint will organize transactions from it into categories such as “Entertainment” and “Food”. Mint’s services are free and users sign up by selecting a bank account or credit card and adding it to the Mint platform.

0 kommentar(er)

0 kommentar(er)